Organizational Profile

The Allstate Corporation is the largest publicly held personal lines property and casualty insurer in America

We provide insurance products to 16 million households nationwide. Allstate was founded in 1931 and became a publicly traded company in 1993. We are listed on the New York Stock Exchange under the trading symbol ALL. Allstate is widely known through the “You’re In Good Hands With Allstate®” slogan.

In 2011, Allstate was number 89 on the Fortune 500 list of largest companies in America. Allstate had $125.2 billion in total assets at the end of 2011, compared to $130.5 billion at the end of 2010.

We have more than 30,000 employees. Of our employees, 32 percent are minorities; 59 percent are women.

Allstate has thousands of Exclusive Agents and financial representatives in the United States and Canada.

Allstate Agencies provide excellent service and a broad array of products to customers who want local advice and a personal relationship with us. We also recognize that some customers are increasingly interested in handling their own insurance needs. That’s why we acquired Esurance and Answer Financial in 2011. The acquisitions make Allstate the only personal lines company that has unique offerings for all customer segments.

We also continued to reinvent protection and retirement for the consumer with innovative products. We launched Drive Wise®, a telematics offering that gives customers discounts based on their actual driving behaviors. Good Hands Roadside, the first nationwide pay-as-you-use roadside service, captured more than 390,000 members by the end of 2011. The four-state pilot of the new Claim Satisfaction Guarantee for auto insurance was successful and led to a cross-country launch early in 2012. We also made progress broadening our relationships with customers by increasing life insurance policies sold through Allstate Agencies in 2011 by 33 percent from the prior year.

This year, we are including expanded information on our operations in Canada and Northern Ireland, as well as online insurer Esurance, which we acquired in the fall of 2011. In the coming years, we will further integrate those operations into our data-collection and reporting processes.

Our Shared Vision

Our Shared Vision provides the “why, how and what” behind everything we do at Allstate. It leverages our strengths while providing the road map for our continued success. When we achieve this vision, we will truly put the customer at the center of everything we do. We will become an even more valuable company to our customers, associates, investors, our communities and society — a company with strong earnings potential and financial performance that sets the benchmark for our industry.

Our Purpose

We are the Good Hands People®: We help people realize their hopes and dreams through products and services designed to protect them from life’s uncertainties and to prepare them for the future.

Strategic Vision

To reinvent protection and retirement for the consumer.

Our Values

- Honesty, caring and integrity

- Inclusive diversity

- Engagement

- Accountability

- Superior performance

Corporate Goal

We will grow the value of our company for our customers, our associates, our shareholders, our communities and society.

Our Principles

- Put the customer at the center of all of our work and provide the products and services they need in ways they want them.

- Take an enterprise view of our people and processes and work as a single team to advance Allstate rather than our individual interests.

- Provide superior returns to shareholders by growing and leveraging risk and return trade-offs.

- Focus relentlessly on those few things that will provide the greatest impact.

- Execute well-considered decisions with precision and speed.

- Hire carefully, develop and inspire aggressively, manage respectfully, empower, reward and celebrate appropriately.

- Be a learning organization.

Our Operating Priorities

- Consumer focus

- Operational excellence

- Enterprise risk and return

- Capital management

For more information, view our vital statistics, which provide information on a state-by-state level.

Financial Strength and Performance

Financial discipline. Prudent decision making. Proactive capital management. These attributes enable Allstate to meet the needs of its customers, reward shareholders and employees, and invest for the future during good and bad economic conditions alike. Financial strength is a prerequisite to grow our business and keep our promises to our customers, investors, employees and communities.

Allstate is one of the strongest companies in our industry. Both Allstate Insurance Company and Allstate Life Insurance Company received an A.M. Best financial strength rating of A+ (superior). At year-end 2011, Allstate held $18.3 billion in capital and our well-diversified investment portfolio exceeded $95.6 billion.

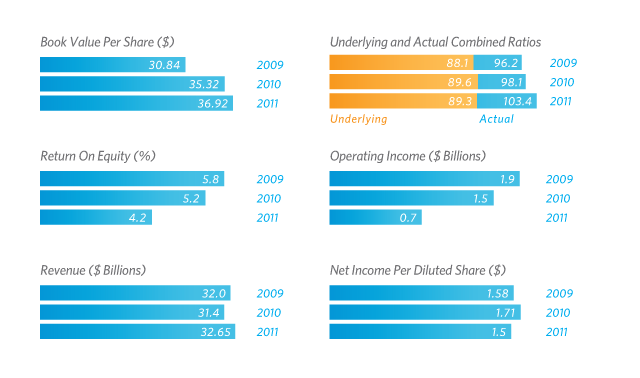

This financial strength benefited Allstate in 2011, a year in which the insurance industry faced continued high costs from extreme weather. While 2011 net income of $787 million, or $1.50 per diluted share, was lower than in 2010, we still increased book value per share by 4.6 percent and returned nearly $1.4 billion to shareholders through dividends and stock repurchases. Revenues were $32.65 billion in 2011 versus $31.4 billion in 2010. During 2011, we also continued to invest in initiatives that help make communities safer and stronger.

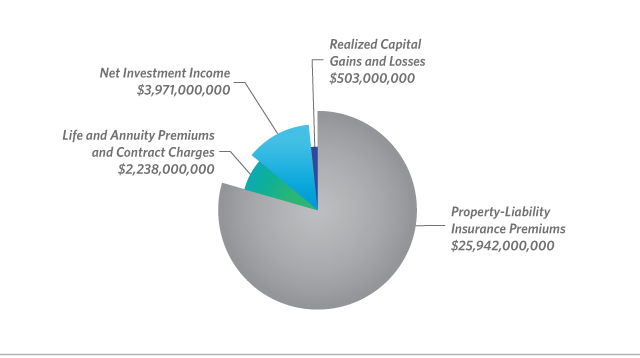

2011 Annual Revenue Breakdown

2011 Annual Revenue By Business Line

Visit Allstate.com for current information about our financial strength, assets, investment portfolio, net income and revenues.

For more detailed financial information, see our most recent Annual Report >